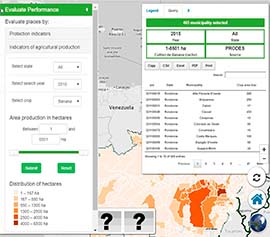

Records the taxes and mandatory contributions that a medium-size company must pay or withhold in a given year, as well as the administrative burden of paying taxes and contributions. This includes:

- Procedures:number of payments necessary for a local company to pay all taxes per year

- Total tax and contribution rate: amount of taxes and mandatory contributions borne by the business in the second year of operation, expressed as a share of commercial profit.

- Time:number of hours taken to prepare, file and pay corporate income tax, sales tax, and labor taxes, including payroll taxes and social contributions.

It is assumed that the entity paying tax is a local limited liability, taxable company, which performs industrial or commercial activities.

The panel presents the ranking of the jurisdiction within the country and allows the comparison of the indicators with the average performance of GCF jurisdictions and OECD countries.

Ivory Cost

Ivory Cost Nigeria

Nigeria

Brazil

Brazil Colombia

Colombia Ecuador

Ecuador Perú

Perú México

México Indonesia

Indonesia

Labor slavery